Contract # P-99155

Fred Phillips, Ph.D. / General Informatics LLC

April 10, 2000

Contents of this Report

• Executive Summary

• Project background

• Data sources

• How universities and incubators interact

and

add value to each other

• Issues and obstacles in

university-connected

incubation

• Private incubator trends

• The Internet

• Summary of survey/interview data

• Case studies

• Recommendations for Oregon

• Conclusion

This report investigates university-connected incubator strategies

for growing new businesses. Its purpose is to make

recommendations

to the Oregon University System for university-connected incubators

within

the State. Such incubators should benefit higher education and

produce

sustainable, equitable economic development.

Because the environment for incubation has changed due to a growing

number of privately owned incubators and due to the Internet

revolution,

this report’s survey-based and literature-based investigation of role

model

incubators was augmented by expert opinion concerning the implications

of privatization and the Internet.

The resulting set of recommendations respects the State’s geographical

and cultural situation. It suggests that incubators and

universities

can offer much to each other, monetarily and otherwise. Moreover,

our universities should play to their strengths, in order to complement

the kinds of services being offered by investor-owned incubators.

In general, according to these recommendations, universities should

refrain from building and owning physical (as opposed to virtual)

incubators.

Exceptions will exist for certain locales, and for cases where the

culture

and organization of the university can adapt, to thoroughly integrate

all

applicable university missions, programs and rules with the incubator’s

imperative to nurture fast-growth companies.

The purpose of this project was to recommend an incubation strategy

for Oregon universities that draws on key success factors from the past

and anticipated key success factors for the new environment of the

future.

This new environment includes the proliferation of private incubators

and

the rapidly growing impact of the Internet.

Different regions and localities in Oregon want and need to

pursue

one or more of the following goals:

- create companies;

- create jobs;

- create and preserve high-wage jobs;

- increase the number of locally headquartered companies;

- build a mass of local suppliers for Oregon’s large companies;

- increase university spin-out companies and technology transfer;

- leverage and increase the technological vitality of the region;

- increase exports from Oregon;

- increase Oregon’s international trade; and

- make Oregon an inviting environment for entrepreneurship;

and to do these things in a way that preserves environmental quality

and provides opportunities for minority, immigrant, and women

entrepreneurs.

The present recommendations draw on incubator surveys, interviews and

visits, and literature search to point the way to an Oregon strategy

that

can meet these goals.

Oregon Graduate Institute of Science and Technology development

a questionnaire that was administered to a number of incubators

throughout

the U.S., Asia and Europe. Nine incubators, most

university-connected,

have returned our questionnaire as of this date. I visited three

incubators and one technology transfer-intensive university research

center

as of the present date, not including our (OGI’s, PSU’s and Lewis &

Clark College’s) own Center for Entrepreneurial Growth. In addition, I

have used extensive notes from incubator visits made by me prior to

this

project, and interviewed a small number of incubator directors by phone

and in person.

These sources update and augment the list of Oregon incubators kept

by the Chancellor’s office. The appendix includes contact

information

for each.

Further ideas reflected in these recommendations are drawn from

literature

review; the complete bibliography appears in an appendix to this

report.

The research plan called for interviews with three experts who are

not incubator directors. All three of these interviews have been

completed: with Laura Kilcrease, first director of the Austin

Technology

Incubator and now a venture capital professional; and with Portland

investor/entrepreneurs

Dwight Sangrey and Al Pruesh, both of whom have investigated a number

of

incubation options for Portland.

Incubators generally engage in one or all of the following

activities:

business assistance to tenants; networking activities; educational

activities;

public relations activities; infrastructure and services; and

interactions

with the university. The university can add value to all of

these.

(The following are based mainly on the experience of the Austin

Technology

Incubator.

Business assistance to tenants. Professional incubator staff

and/or MBA students may review monthly financials with tenant

companies;

provide access to a “know-how network” of service providers; or

introduce

the companies to experienced mentors or foreign markets and sources of

supply. The incubator hosts venture fairs at which tenant

companies

may present to VCs and angels their brief pitches for funding.

Networking activities. The incubator introduces the tenant

companies’

executives to the local business “power structure” and to

representatives

of other technology regions and companies. This activity includes

receptions and social events.

Educational activities. Tenant execs may sit in on university

classes. The incubator is site of brown-bag lectures, workshops

and

seminars on a variety of entrepreneurial skills - benefiting students

as

well as incubator tenants.

Public relations activities. The incubator issues pamphlets,

press releases and other literature promoting the tenant companies

jointly.

The incubator itself is newsworthy as a sign of the community’s

commitment

to supporting entrepreneurship. The incubator helps members of

the

know-how network publicize their connections with incubator companies.

Infrastructure and services. Needless to say, the incubator

maintains

attractive space, shared conference rooms, refreshment rooms and

reception

area. Services may include shared office machines, receptionist,

central switchboard, and security. These days high-quality wiring

and fast Internet access is a minimum requirement.

Interactions with the university. The university and the

incubator

provide each other with opportunities for interns, spin-off companies,

exploitation of intellectual property, and educational

enrichment.

More about this below.

Indeed, university-incubator interaction enhances almost all the

incubator activities mentioned above. In particular:

• The incubator can host business school classes. In one such instance, engineering and business students teamed for a robotics venture laboratory, combining technical design and business planning for special purpose robots, with an eye toward launching a new venture. This writer has taught a high technology marketing laboratory for MBA students, using incubator tenants as living cases. Another possibility is the “incubator operations laboratory,” preparing students to run incubators and related entrepreneurship facilitating organizations.

• The incubator provides internship opportunities for science, engineering and business students. In these arrangements, interns learn the reality of entrepreneurship. Interns become employable, as the real-world experience on their resumes demonstrably increases the number of job offers they receive. Internships benefit the incubating companies also; tenants are exposed to the latest academic knowledge, and enjoy intelligent, inexpensive labor.

• Incubator entrepreneurs are valuable guest speakers in academic classes. These guest appearances add value to students’ academic experience, and give the entrepreneurs a chance to field critical questions.

• Tenants provide “living cases” and student projects. Living cases are more interactive than, e.g., written Harvard cases, giving students recourse to further information and the chance to actually have an impact on the operations and success of the subject company. Of course, these also can lead to student employment.

• The incubator provides beta sites for student new venture competition teams. The prospect of space in the incubator is an added incentive and reward for students competing in university-sponsored business plan contests.

• The incubator is a link to BBA/MBA concentrations in entrepreneurship. The presence of a living laboratory for entrepreneurship is a marketing plus for the university.

• The incubator is a link to university-wide associations and student organizations. Student entrepreneurship clubs, technology management interest groups and the like are enriched by the presence of the incubator. Connections to the alumni association are valuable as well.

• The incubator as a fund raising attraction. Alumni may be delighted to see that the university is taking practical steps to encourage entrepreneurship. Many of a university’s wealthiest alumni are entrepreneurs.

“I have been affiliated with our local incubator since its

beginning.

Since then, I have been on the board of directors to manage the

facility.

Although we are not affiliated with a university, I can see many

benefits

of such a relationship. For example, market assessments,

prototype

development, testing, surveys, etc., can be done by students when

available.

I believe an incubator in a community is a valuable asset independent

of the form of its organization.”

Marv Clement, Battelle-Pacific Northwest Laboratories

A 1995 Coopers & Lybrand study, quoted in Hayhow (1996), showed

that companies availing themselves of university resources “had

productivity

rates 59 percent higher than peers without such relationships” but that

only 40% of companies surveyed actually used university

resources.

“Forging ties with a university is beneficial,” C&L conclude, “yet

most companies apparently need a push in this direction.”

Incubators

can provide this push; according to Glenn Doell, formerly director of

Rensselaer’s

incubator, “Incubators should consider developing a strong partnership

with their local institution of higher learning.”

The Milken Institute reports that “Research centers and institutions

are indisputedly the most important factor in incubating high-tech

industries.”

Universities attract federal funds and donations from wealthy alumni

interested

in entrepreneurship. Universities provide a flow of new

knowledge,

ready access to existing knowledge, able contract research,

enthusiastic

students, and ambitious, knowledgeable graduates who have a global

outlook

but also an emotional attachment to their college town. There

could

be no better ingredient in a recipe for technology entrepreneurship and

economic development.

The various incubator-related conflicts of interest and

intra-university

conflicts are summed up by the following, admittedly extreme, scenario.

A professor at a public university, working on a federal grant,

discloses

a laboratory innovation to the university, which patents it and

licenses

it back to the professor. The professor starts a company and

brings

it into the university-owned incubator. The incubator receives

equity

in the company. Further R&D is performed within the company,

and part of it is done in the professor’s university lab under a grant

from the company to the university.

Objections to these activities start as a trickle and end as a

flood.

Parents complain that the professor should be in the classroom teaching

their offspring, not using university time to start companies.

The

professor’s dean wonders whether the professor is in violation of the

university’s

conflict of interest policy. The university president’s office

complains

that the portion of the company R&D done at the company, that is,

inside

the university-owned incubator, does not generate overhead cost

recovery

funds for the university. The university president herself, asked

by a local investor whether the company is a viable investment, fears

she

cannot give a frank assessment of a firm in which the university owns

stock.

The president, used to dealing with large corporations that are

university

donors, doesn’t know how to interact with small, entrepreneurial

concerns.

Her clumsy communications lead the company’s employees tell the press

that

the university president is threatening them.

The university’s finance VP is accustomed to viewing only land,

equipment

and buildings as university assets (all securities investment activity

is handled “downtown” at the university system level). Because

the

incubator generates stock equity and eats cash, the VP threatens to

shut

down the incubator. The System Chancellor fears that if the

incubator

too successfully creates economic development in the local area, state

legislators from distant counties will accuse the system of geographic

favoritism and veto the Chancellor’s bid for increased university

funding

next year.

Documents that the company views as proprietary (but were generated

during a meeting with incubator managers) are released to the public

under

the state’s open records act. The company sues to recover the

documents,

charging a breach of trust and malicious negligence, but fears that

either

way, the federal Freedom of Information Act may cause them to lose

control

of their intellectual property because the original research - and the

closely related ongoing research under a new NSF grant in the

professor’s

lab - was federally funded.

The professor’s need for interns at the company is urgent, but the

university’s business school has not added entrepreneurship courses,

and

teaches a curriculum geared only for future employees of large

companies.

As a result, no qualified interns are available to incubator

companies.

The professor complains further that the university urged him to

commercialize

his invention and provided an incubator, but did not counsel him on the

problems that would arise, nor warn him that the university would later

appear to be working against him.

The provost and the university comptroller call the professor and

the

incubator director daily, reciting the list of disasters that will

occur

if any current federal money pays for university equipment or personnel

that are used for the private benefit of the company.

Some universities (including University of Alabama - see Hayhow, 1996)

avoid some of these difficulties by setting up a private foundation to

administer an incubator, with the foundation chartered to benefit the

university

without being subject to university rules. Other universities set

up a for-profit company to hold equity in incubated companies (see

Kalis,

1997). “The key is to manage conflict of interest situations, not

avoid them completely,” says Glenn Doell, former director of

Rensselaer’s

incubator (Hayhow, 1996), “If you try to completely avoid conflict of

interest

situations, you lose much of the potential benefit of the

[university-incubator]

relationship and you won’t have any faculty-founded companies.”

Doell

advocates warning all parties (the university I.P. and research

administration

offices, plus deans, department heads, and incubator staff) when a

potential

conflict arises, and urging all to document actions and precautions

taken.

One respondent to Bienkowski’s (2000) email survey said, “We want to

encourage entrepreneurship and faculty startups, but want these

enterprises

to be separated cleanly from university activities.” This is a

wish

that cannot be completely fulfilled.

The Oregon University System appears to be appropriately sensitive

to issues of using public university resources for private gain, but

reluctant

to test its procedures by trying new things. OUS’s

commercialization

and spin-off experience is limited (though individual OUS employees

have

considerable experience in these areas). The System is

decentralized,

but sensitive to the need to benefit all Oregon counties. This

report’s

recommendations are based on these perceptions of OUS.

In the 1980s and ‘90s, most of the incubators in the U.S. were what

we dismissively called “real estate operations.” This meant that

universities were not involved and that tenants received no business

assistance

other than a shared receptionist and photocopier. James E. Burke,

Ph.D., President of Burke Information Technology Services, describes

(via

email, 8 Mar 2000) the trend toward more responsible,

higher-involvement

private incubators:

Many of the original incubators were established by corporations

first

as an effort to commercialize some of their technology and later to

allow

employees with ideas to develop them with company backing. These

incubators had some success but then the corporations became more

flexible

about where the startups could locate and got away from maintaining a

building

site.

A recent development in incubators is the rush to create web-based companies in order to reap the rewards of "dot.com" valuations. These are usually setup and managed / financed by venture capitalists and other sources of financing. Once the management team is in place, the venture capital management oversight function comes to the fore, and its convenient to have all of the companies in one place.

Burke gives a list of private net-incubators:

• Campsix Inc. (formerly Net2Future), www.campsix.com

• CMG Inc, www.cgmi.com

• Divine InterVentures, www.divineinterventures.com

• eCompanies, www.ecompanies.com

• eHatchery, ehatchery.com

• Garage.com, www.garage.com

• Idealab, www.idealab.com

• I-Hatch Venture, www.i-hatch.com

• Intelligent Systems Corp., www.intelsys.com

• interactive Minds, www.interactiveminds.com

• Internet Capital Group, wwwicge.com

• Venture Frogs, www.venturefrogs.com

To this list we may add: Dreamscape Ventures,

www.dreamscapeventures.com.

In addition (Leander Kahney, “A Capital Plan for College Ideas.”

Wired.com,

Apr. 3, 2000), “Late last year saw the launch of a slew of new

Intellectual

Property marketplaces, including yet2.com <http://www.yet2.com>,

which

concentrates on selling technology developed by corporations; TechEx

<http://www.techex.com>,

which focuses on the life sciences; and the Patent & License

Exchange

<http://www.pl-x.com/>, a patent auction. UVentures.com

attempts

to broker university patents to potential licensees via the

Internet.

Its founder, Craig Zolan, thinks university I.P. generates insufficient

returns for universities because university I.P. offices rely on “a

hopelessly

outdated business practice”: personal contacts. In my opinion,

his

venture (and the similar Knowledge Express in Berwyn, PA) may generate

some licenses, but violates the wisdom that “technology transfer is a

body

contact sport.” Personal contacts will remain important, and thus

local incubation will remain an important tool.

It now appears the “Big Six” accounting/consulting firms will also get into the act:

Note that in chatting with an exec from Deloitte and Touche at a

Corp.

Investment conference last week, D & T is also planning similar

investment/

incubation activities and thus, I'd assume PWC and others will follow

suit.

Wonder if we can count on them to offer not only financial services,

but

access to ERP, MRP, and/or CRM expertise and capabilities.

via email, from Christopher J. Meyers

Vice President, Corporate Services

Select University Technologies, Inc. (SUTI)

Costa Mesa, CA

I have to note my disagreement with Jim Burke’s further assertion:

A recent development that may turn the web-based incubator approach

into an entirely new kind of economic development engine is the

creation

of wealth through the interactions of the startup companies within an

incubator.

The image is that of the Japanese keiretsu where all of the startup

companies

and their partnering (and sometimes funding) corporations have special

business relationships with each other.

The Japanese keiretsu have been weakened by their extensive foreign

operations, which dilute their cohesive culture. Incubator

companies

must be networked globally to take advantage of the global markets

accessible

by the Internet. The keiretsu is not a viable model, especially

when

it focuses companies excessively on alliances with other physically

proximate

companies at a similar life cycle stage.

It is now commonly said that “The Internet changes everything.”

Here is what is meant by that. The Internet provides...

• streamlined inventory and distribution, making otherwise

low-margin

businesses feasible.

• fast distribution and customer feedback.

• global distribution, even to special-interest markets.

• many new business opportunities for networking the citizens of the

world.

While it shifts power to consumers, the Net revolutionizes

relationship

marketing. Producers, while losing price leverage, gain

information

leverage.

For software businesses, the Net makes version control easy, and for

this and other reasons, empowers small developers.

The Internet allows many kinds of resources to be pooled over larger

geographical reaches, indeed globally, and this is the rationale for

the

recent growth of online incubators and online intellectual property

auctions.

The explosive growth of the Internet itself provides business

opportunities

for companies building net tools, i.e., the software that underlies

e-commerce,

and the hardware (servers, routers, etc.) that carry messages across

the

net. This is knowledge-intensive work, and naturally its manpower

and much of its intellectual property will be supplied by universities.

The Internet is a new communications medium that offers desktop

videoconferencing,

telephony, synchronous text chat, publishing, broadcasting, virtual

reality,

and asynchronous bulletin boards. These multiple channels of

communication

increase the chances that ideas can be conveyed accurately and

relationships

cemented without travel - although almost all experts agree that in a

customer

or alliance relationship, face to face (“FTF” in net-speak) contact is

needed sooner or later.

If Andrew Grove is correct that “soon all businesses will be

e-businesses,”

then indeed the Internet changes everything.

This study used expert interviews and incubator surveys as well

as incubator visits and literature search to form its views. The

incubator survey form appears in the Appendix with the answers given by

all respondents. The expert interview questionnaire consisted of

only three questions:

1. How has the Internet changed new business incubation?

2. How has the trend to privatization of incubators, especially

under the ownership of investor groups, affected the university’s role

in incubation?

3. How can universities best interact with incubators in the

‘00s?

The experts’ answers were (in paraphrase):

Universities need not spend capital at this time to build or run

incubators.

Nowadays, incubators should pay universities to participate.... Even

back

in the 1970s, RPI [Rensselaer Polytechnic Institute, in Troy, N.Y.]

recognized

privatization was the way to go; all RPI incubators are in

partnerships,

except its on-campus one. Universities should be paid for the

things

they are good at (facilitators, nursemaids, incubator managers,

educators,

technology transferors, supporters of entrepreneurship, and carriers of

a collegial culture) - not for things they don’t do well, like being

landlords....

Private incubators are likely to be boutiques, with a narrow industry

interest

and focus....The Internet helps close funding deals after just one

FTF.

(Dwight Sangrey, 4/7/00)

Portland senior executives would like to participate [in incubators]

as mentors.... With other executives, I have approached a number of

private

incubators asking them to establish a branch in Portland.... This would

facilitate my merchant banking activities, bringing together management

teams and investors.... The Internet is great for communicating,

exchanging

ideas, and proving business ideas in a short time. (Al Preush,

4/3/00)

Privatization of incubators is driven by the Internet sector and

VCs.

VCs want fast companies, like Internet plays. Privatization is

driven

also by the real estate shortage in high growth areas, and by the

growth

of the stock market. Because all these things can change rapidly,

the continuation of private incubation cannot be relied upon.

Before

the World Wide Web, private incubators tended to last a maximum of two

years. Now, with the Net, [the private incubator arm of] Softbank

only lets companies stay in for 6 months! This is not really

enough

to lend significant business assistance.... Net companies have

intensive

supplier/customer networks and have to locate close to similar

companies

and to sources of labor; with luck, their economic impact will trickle

down to outlying regions.... So not all incubator activities will serve

all state economic development goals. (Laura Kilcrease, 4/4/00)

The following summarizes the most notable patterns in the incubator

director survey responses.

1. Square footage. Respondents indicated incubator sizes ranging

from 1,800 to 40,000 and more rentable square feet. Nearly all,

regardless

of the size of their incubator, believe their square footage is

insufficient

to serve market demand and/or achieve economies of scale.

2. Quality of physical plant. While undergraduates may find charm

in lecture halls that have not been renovated in 75 years, incubators

do

no favor to tenants if the incubation facility is not suitable for

entertaining

customers and suppliers, or not convenient to airports and major

highways.

Most incubators surveyed occupy class A space, but some of these cite

inconvenient

location. In addition, while most claim to be breaking even

financially,

“deferred maintenance” of physical plant is often cited as a concern,

indicating

the incubators are not making money on a fully cost-loaded basis.

3. Tenancy and services. Most respondents indicated their

incubators

offer the full range of services prompted by the questionnaire, though

most seem to review tenants’ financials rather infrequently. Most

allowed direct competitors to occupy incubator space at the same time -

though this will necessarily cut down on the social interaction that is

a prime benefit of physical incubators. Number of tenants housed

ranged from 4 to 30, with a mean of 19. Many discount market

rents

by as much as 50%, though experts argue that such discounting is a

needless

crutch for truly competitive companies and is an unfair return to the

incubator

considering the services offered (very few respondents take equity in

tenant

companies to offset rent reductions).

4. University involvement. Answers ranged from none/informal

university connections to full university-owned incubators. Even

the latter seemed to integrate university activities (academics,

seminars,

internships, tech transfer, etc.) piecemeal or incompletely. All

agreed university involvement is good for incubator entrepreneurs, most

agreed such involvement is good for the university as a whole, and

fewer

that university involvement in incubation is essential for either the

incubator

or for university MBA/BBA programs.

5. Staffing and finances. Tenure of directors varied

considerably,

though most had been on the job a short time. (Incubator

directors

may use the job as a steppingstone to positions with investment firms

or

with startup companies, so there is much turnover among incubator

directors.)

Most incubators claimed “breakeven or better” financial

performance.

However, most derived funding from a variety of government,

philanthropic

and university sources (only one claimed breakeven on rents alone) in

addition

to tenant rents - so “breakeven” may be a result of university

subsidies,

rather than net of such subsidies.

6. Networking. Most incubators surveyed are NBIA members, and

maintain relationships with at least one incubator in a distant

location.

All agree the Internet has benefited incubators and incubator tenant

companies

as a communication tool. The most often-cited benefits were “More

dotcom startups are applying to your incubator” and You are better able

to find suppliers and customers for your tenant companies.” Close

behind were “Your tenant companies can more easily work with other

off-site

service providers” and “Your tenant companies can more easily work with

companies in your allied regions.”

Case Study #1

This case is based on an interview with Dr. Roger Stough, Director

of the Mason Enterprise Center. In his capacity as Director, Dr.

Stough reports to the Provost and President of George Mason University.

MEC runs a number of incubators, the number depending on how virtual

incubators and incubators run on contract are counted. One of the

incubators is a physical one occupying two floors (4,000-6,000 sq.ft)

and

designed to shelter 16 companies (of any kind).

Another is an “incubator without walls,” or "Technology Resource

Alliance"

that works with 30 companies/year. These companies are pre-launch

or immediately post-launch, technical companies only. They enter

the resource alliance by application, and only the best are accepted.

MEC also runs three federal telework centers (cubicles with internet

access, videoconferencing, computer training room). These are

scattered

across northern Virginia, but all are in the general radius of

Washington,

D.C.

In addition, MEC manages an international incubator for Arlington

County,

for foreign companies wanting to do business in the U.S.

MEC holds contracts for four Small Business Development Centers

(SBDC’s).

The SBDCs emphasize mentor/protege programs. In contrast to the

competitive

Technology Resource Alliance, the mentoring program accepts anyone

wishing

to start a business. A $1,000 small business loan (microloan)

program

is also administered. These are funded by separate federal

programs,

mostly intended for non-technology businesses. After completing

the

basic mentoring program, companies contract with the SBDC for

additional

services.

MEC operates a "Grubstake Program" that resembles venture fairs for

angels and VCs, and cooperates with the local "Venture Investor Club"

(=angel

network) to general leads to promising companies. A particular

strength

of MEC has been in naming, promoting and branding their programs in

this

way.

For example, MEC’s Dry Run™ teaches CEOs how to make a pitch for

funding.

The executive’s presentation is heard initially by internal staff, and

after, by a panel of outside advisors similar to those assembled by the

Oregon Marketing Business Initiative (OMBI).

MEC finds money from: Federal, county, fee for service (mentoring

program), and state and university matching funds. MEC’s funding

dictates that they must service small and minority businesses.

But

as community leaders agree that high-growth potential businesses are

usually

technology-based, MEC finds it can bend/leverage all its funded

programs

to encourage high tech entrepreneurship. MEC does mentor/incubate

direct competitors, but at such early stages that “it doesn’t matter.”

University involvement is not a critical success factor for MEC,

according

to Dr. Stough, but is good for the university, especially due to

student

involvement in community relations and fund raising. MEC’s

network

provides leverage for research contracts that come into the university

having to do with measuring specific aspects of the local and state

economies.

MEC is linked with academic programs in entrepreneurship throughout

the university (business school, engineering, public administration,

art/multimedia_

leading to university-wide minor. GMU doesn’t have a full-time

MBA

program, so MEC fielded a campus-wide "entrepreneur profile"

questionnaire

to find students with experience starting businesses. These

students

will be MEC mentors and interns.

Dr. Stough is also a faculty member at GMU’s The Institute for Public

Policy (TIPP). MEC depends on TIPP’s fund raising skill, but is

kept

arms-length from TIPP to avoid intra-university jealousies.

There are cultural as well as budget tensions within university because

in MEC speed, not consensus, is of the essence. The university is

better for coaching launch of non-Internet companies, Stough says,

because

it can take the time that is customary for university activities.

One MEC success was the launch of a heritage-based travel

service.

But even this company leverages the net for, e.g., real-time itinerary

changes.

AOL and other N. Virginia companies have created 4,000 millionaires

and several billionaires. MEC leverages these for a 400-strong

"knowledge

network," drawing on these executives for advice on fast

turnaround/short

window dotcom opportunities. The Internet enhances communication

among these advisors - especially if they have worked together before.

MEC hired a retired Peat Marwick executive as Executive in Residence

(at $90,000/year) to leverage his network for the benefit of MEC

companies.

The executive mentors companies and mentors incubator managers.

This

works well; Roger may hire another such executive.

Pieces of MEC have been evolving since 1986. Not a planned from

scratch effort, in fact, according to Dr. Stough, it is "something of a

mess". MEC’s total budget is $7 million/year. MEC worked

with

1,600 companies last year in one way or another, and helped companies

get

money from $50k to $10m.

Mike Kehoe (703-277-7701, mkehoe@gmu.edu) is executive director of

MEC. MEC’s website is

http://www.gmu.edu/departments/tipp/center/center.htm.

While MEC continues to manage incubators on contract for county,

military,

etc., it is moving away from in-house, physical incubators. Roger

advises not building bricks-and-mortar incubator unless a big region

doesn’t

have a private one. Only do bricks-and-mortars in rural areas if

the state provides funding specifically for that purpose, he

says.

Otherwise, just do traditional SBDC activities in rural areas.

But

other arms of MEC can buy the time of SBDC staff to help with urban

incubators.

The University’s contribution, then, is to manage incubators for

private

parties (in Oregon, this is CSI [Creative Services Initiative], Rainy

Day

Ventures, etc.) with low-cost student labor.

Case Study #2

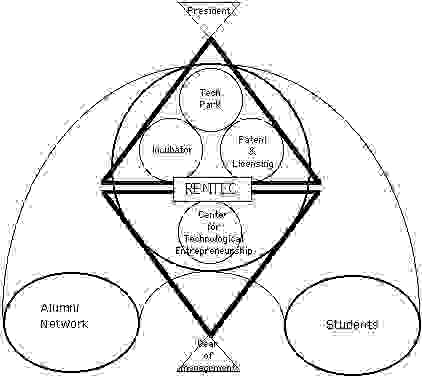

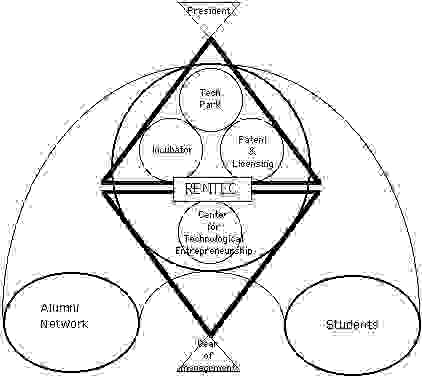

Entrepreneurship, Incubation, Technology Park &Technology Licensing

at

All four campus organizations involved in these areas (see picture

below) are tightly coordinated, even though one is under control of the

management dean and the others report to RPI president. It must

be

said that this tight coordination depends on the goodwill of the four

area

directors. The four together are called RENTEC. The campus

licensing/patenting office is now called Office of Technology

Commercialization,

and is located in the incubator building

RPI is known as an entrepreneur-friendly school. Students and

faculty come to RPI because they can "bring their companies with them."

RPI files 6-8 patents/year, selective by commercialization

potential.

As at other universities, very few patents pay off their costs.

One

answer is being more selective (difficult if faculty with a lot of

clout

want to file many patents); another is to have similar schools pool

efforts.

"Alums who have ignored RPI for many years have gotten excited again

due to RPI's entrepreneurship focus." -Mike Wacholder, RPI.

Bill Stett, a retired entrepreneur who is now Dir. of Center for

Technological

Entrepreneurship at RPI, teaches alliances and acquisitions. Bill

confirms that the entrepreneurship center opens new areas of

philanthropy.

CTE raises as much each year as the management Dean - but tries not to

compete.

RPI’s Lally School of Management has a faculty area called

"entrepreneurship

& strategy." This ensures that entrepreneurship is not a

stepchild

academic area. Stett says indeed entrepreneurship is central at

the

Lally School. Entrepreneurship faculty can get tenure at Lally.

But

Lally faculty are not strong in all entrepreneurship skill areas; Stett

wishes for a good venture financing course.

At RPI, entrepreneurship faculty can get tenured - entrepreneurship

is central, not an academic stepchild at Lally School.

Stett recommends getting older entrepreneurs involved first in teaching

and mentoring - donations will then flow.

Case Study #3

This park is currently run by a mixture of state and county

agencies.

The County of Maui is attempting to buy the park, which was originally

a private development. The park is located near the Air Force’s

astronomical

observatory, and houses a major Department of Defense supercomputing

center,

the Maui High Performance Computing Center (MHPCC). While the

park

houses industry outreach offices of U. of Hawai’i at Manoa, U. of

Hawai’i

at Hilo, and Maui Community College, the universities have no direct

role

in running the park or its incubator. The supercomputing center

is

run by the University of New Mexico under contract to DoD.

• Allows companies to retain all I.P. to code used at MHPCC.

All

companies are charged at same level for using MHPCC.

• If labs agree to give free time to a company, lab (MHPCC) can option

the I.P. or put it in public domain.

• Undergrad and graduate academic programs.

• Can work with foreign companies if via a "U.S. connection".

But all work is subject to US export restrictions.

• A company using MHPCC remotely may decide to keep a small local

office

at MRTC, especially if cooperating with an Asian company.

The supercomputer center’s mission is primarily to analyze signals from the Air Force telescopes - mostly "space junk" and colliding asteroid studies.

source: Margaret Lewis, MHPCC.

The Park’s best success so far is a Japanese company, "Micro-Gaia,"

that produces gene-engineered algae. Real estate in Maui is still

cheaper than Silicon Valley, and offers location appeal to Silicon

Valley

business people who have built strong ties to Maui through a history of

vacations on the island. The number of direct flights and

carriers

serving Maui-California routes is increasing.

MRTC covers 300 acres, with 48,000 sq.ft. of buildings. State

funds were provided for "front end" work on the supercomputer, though

most

of the startup of the park was privately funded. MRTC houses:

- an incubator (23,00 sq.ft. leasable)

- U. of Hawaii’s tech transfer office

- currently, 8 companies and "phase-in" companies (for 2 years),

- space for “work teams”

- interim locations for relocating companies.

The period of incubation is less than five years, but is

flexible.

Services provided include:

• low-cost space (on par with other class A space, but services are

included. $1.90/sq.ft; commercial is $2.20) B space is available on

Maui

at $1.00/ft.

• copying, etc.

• business advice

• SBDC

• business research library

MRTC Director Tak Sugimura is "leveraging resources" to "zap the

gap,"

engineering local lab results in order to lure licensees.

The running of the incubator is the responsibility of the Maui Economic

Development Board, a 501c3. Thus, MEDB employees may coach

incubator

tenants without fear of losing control of data due to open records

laws.

Through MRTC, MEDB was the first Internet service provider on the

island.

MRTC has an underutilized videoconferencing facility, but gets some

money by renting it out. There are also distance learning

classrooms

that haven’t been used yet; MRTC wants to network with many U.S.

universities.

MRTC is just blocks from hotels, but is a considerable distance from

Maui airport.

Park buildings are state funded. The land is a private

development,

but land on which the state buildings are, have been donated to the

state

by developers. Now the county is trying to buy it all.

MRTC doesn’t pay rent, but does have to cover building operating costs,

and does get a management fee from the state. The state currently

covers major repairs, but doesn’t want to ultimately. MRTC is now

self-sustaining, exclusive of major renovations. Leases are

month-to-month;

with companies admitted by business plan.

There are:

• 100 full-time employees in incubating companies

• +22 full-time for Mauinet (a graduating company)

• +15 part time

• Direct competitors are allowed

• Build-out is tenant responsibility

• No equity taken in incubated companies

MRTC tries to focus on "good match" technologies. One of these

is MicroGaia’s algae food supplement, which has a high markup per ounce

and can grow in Hawaiian waters. Another is hi-speed photography,

adapting astronomy photographic techniques to the photographing of

water

sports. A third is business website design/hosting, which can

build

the export potential of Hawaii businesses.

MRTC remains weak in connections to VC and Angel capital.

Calvin Nemoto is Executive Assistant to Maui County Mayor James

Apana.

Mr. Nemoto is trying to partner with Sonoma State University to build a

private high school and a 4-year college in Maui. The county’s

overriding

goal is "workforce development".

There are "several hundred" technology companies in Hawaii, but most

are 1-2 person. The County believes it is important to let people

know that there is room to grow their companies on Maui, and that Maui

is entrepreneur-friendly. Like Austin in Texas, Maui has a

reputation

for going their own way, even when that means not cooperating with

State

of Hawai’i initiatives and the wishes of the Governor. The

widespread

attitude on the island that “Maui No Ka Oi (Maui is the best)” may turn

out to be a central factor in their success.

Case Study #4

This case is summarized from Tice (1999). The institute, funded

with $4 million from UW, will utilize the best principles of

university-incubator

interaction, serving learning and teaching objectives for the

university

and the community at large. Additional funding will be sought

from

public and private sources. Bob Miller, UW Director of technology

transfer, says students from business, law, engineering, and the

sciences

at UW will be involved in the institute, and the new institute should

generate

additional faculty positions. Intellectual property issues will

provide

academic fodder for business and ethics students. Faculty will

not

be allowed to be officers of incubator companies, nor take grants from

incubator companies.

In the past, according to UW business prof Ken Walters, more than 140

companies have been created from UW intellectual property, comprising a

total of $10 billion in market capitalization. Ninety percent of

these companies remain headquartered in Washington state, or keep

significant

operations in the state after being bought out by out-of-state

concerns.

The Technology Enterprise Institute will occupy a 40,000 square foot

facility in West Seattle.

These recommendations cover the following areas:

Should universities build or own physical incubators?

Should universities be involved in incubators in any way?

How can universities demonstrate success in incubator efforts?

What will attract desirable incubator tenants in the 2000s?

What should Oregon universities do?

• Generally, no. Universities should not build or own

"in-house" bricks-and-mortar incubators,

- unless they can leverage an assured supply of

* high-quality surplus space (office, laboratory, and/or manufacturing

space)

* qualified student labor

* surplus furniture, lab equipment

- especially if internal university concerns about overhead recovery,

the noncommercial mission of the university, or commingling of funds

(commingling

can and must be avoided!) are likely to paralyze the incubator effort.

• Ten years ago, the incubation concept was new.

Universities

provided “proof of concept” and researched the value and operations of

incubators. Private incubators were often just “real estate

operations,”

providing no business mentoring to tenant companies. Today,

incubation

is a well-accepted notion. Well-funded VC firms, angel investor

consortia,

technology brokers, and even law firms run their own incubators, and

have

every incentive to provide comprehensive business advice to

tenants.

Universities still have valuable contributions to make, but cannot

compete

economically running a full-service incubator in-house.

• Yes! University involvement in incubators can benefit the

university and the business and entrepreneurial public.

- Benefits flow in all directions.

* The university offers valuable knowledge, social support, technical

support and student labor to entrepreneurs.

* The university offers the incubator a credible profile in the

community.

* The incubator offers valuable educational and outreach opportunities

for students and faculty.

* A university that shows activism in entrepreneurship can attract

increased philanthropic donations.

- But a university incubating strategy must fit within an

educational

and/or economic development strategy. The larger strategy may

involve

workforce development, entrepreneurial graduates, or one of many other

possible such missions.

* An incubator can be one of several programs that fulfill the larger

strategy.

* The director of the collection of programs must be empowered to

announce

the strategy to the public and to execute the strategy - not to be

pulled

in conflicting directions by the differing objectives of the university

and multiple funding agencies.

• But universities should not engage in incubation unless:

- unless Freedom of Information (FOI) regulations are finessed.

* A procedural firewall must exist between tenant company meetings

and state/university employees. Any university property used in

connection

with tenant company business - or any notes taken by university

employees

extending business coaching to incubator tenants - may open the door to

FOI requests. The danger of this would discourage high-potential

companies from applying for admission to the incubator.

- unless it is the explicit policy of the university that incubation

is part and parcel of the university’s teaching and community service

roles.

* Through operational programs and P.R., the university must integrate

incubator activities with the missions of the university:

education,

research, community service, and state and local economic development.

• Universities running incubators should be prepared to use

sophisticated

methods of branding and targeted selling to recruit companies, capital

and mentors, as well as to market the incubator internally to faculty

and

students.

• An incubator with a 3 year exit policy cannot have a large

economic

impact in the short term. However, politicians, funding agencies,

and university administrators who support the incubator will ask for

quick

results. The incubators should strive for and publicize:

- number of companies admitted

- number of companies applying

- admittees’ initial funding levels

- sq. footage filled

- tenant company’s subsequent funding

- frequency and quality of educational and networking events,

and size of audience attending

- employment growth in tenant companies

- public cost per job created

- number of professional service providers pledging pro bono

hours

- product launches

and other measures that, individually or as ratios, indicate a promise

of significant economic impact.

• Only a sustained, high-intensity effort will bear fruit for a

regional

strategy. One networking/speaker event per month will not

materially

help entrepreneurs, nor create economic growth. Trying for a year

to build an entrepreneurial environment, then giving up, will do no

better.

Can universities, investors, service providers, associations and

governments

work together to assure two or more educational events per week for

five

years? Only this level of commitment and performance can build a

perceived presence and offer programs that actually reach busy

entrepreneurs

and executives.

• Focus on strategic technologies and business areas. The

Maui Tech Park is strong in this regard, emphasizing opportunities for

building businesses around ocean farming, natural nutraceuticals,

and

technologies deriving from the local strengths in astronomy and

supercomputing

(high-speed photography and “space junk” technologies).

• The Internet facilitates low-cost collaboration at a distance - after people have become acquainted face to face. It also provides worldwide markets for local companies. According to Intel founder Andrew Grove, “All businesses will be e-businesses.” But this does not diminish the importance of “FTF” (face to face) contact with customers, investors, and suppliers.

- Universities can contribute to the e-business success of tenant

companies

by

* using their Internet expertise to provide support and new employees

to the tenant companies.

* giving the incubator enough autonomy to truly help companies

competing

“on Internet time.” Universities tend to operate on consensus,

not

on speed. This mode is not acceptable if the university incubator

represents that it can help Internet startup companies; any

bureaucratic

slowdown that stalls an Internet company will be broadcast over the Net

at light speed, with sudden and total loss of credibility for the

university

and the incubator.

- Universities can contribute to the face to face aspect of globally

networked entrepreneurship by:

* leveraging visits of foreign scholars and officials by introducing

them to incubator tenants, and

* using their downtown centers in major metro areas to host meetings

for entrepreneurs and incubator tenants from statewide and beyond.

• Low real estate costs are an attractor for new and relocating high-growth-potential companies that are potential incubator tenants.

- But are not sufficient, if there is not also excellent

transportation

and communications infrastructure surrounding the incubator.

- Universities with attractive surplus space are better suited to take

equity from companies, as cash flow is not critical to most

universities.

• There are opportunities for university-owned incubators in less

urbanized

areas to attract promising tenants. This is a speculative

assertion;

it will be set forth in detail in this project’s final report.

• Universities should understand their strengths vis a vis incubation;

attract funding to build on those strengths; and play to their

strengths

and their mission in the marketplace. Public universities serve

geographical

areas sparse in entrepreneurial infrastructure. They take the

long

term view. They are well-connected with local businesses and

local

problems, but network with far-flung scholars and alumni. They

have

the loyalty of young people and their families.

Oregon universities may constructively build, own and run

incubators...

... when the university is located in an area of low-cost real estate.

... to serve companies that are not “living on Internet time” and yet

have significant growth potential.

... where a community effort can be sustained without pressure for

short-term results.

... if the university can leverage its contacts and its

communications/transportation

facilities to connect companies to investors, customers, advisors, and

suppliers.

This is, perhaps, a rare situation. But results could range from

the creation of a few jobs and companies, to the complete economic

transformation

of the community. The university can enjoy long-term capital

gains

from equity in tenant companies.

Oregon universities should partner with investor-owned incubators...

... in more urbanized, high-cost areas.

... to serve new businesses that face severely limited windows of

opportunity.

In either case,

Oregon universities should seek funding to prepare themselves for these

roles. Funding can be applied to...

... expanding academic entrepreneurship programs;

... educating faculty about the procedures and rewards of university

patenting, licensing, and spin-off formation, and helping them decide

when

to publish and when to “disclose” to the university intellectual

property

office;

... joining the National Business Incubation Association;

... offering outreach programs to immigrant, women and minority

entrepreneurs;

... setting up internship programs;

... sending student teams to national and international new venture

competitions;

... engaging more business executives and investors in university

classes,

organizations and activities.

Universities have a constructive role to play in new business

incubation.

Oregon universities should take care that their incubation activities

complement

rather than duplicate those now provided by private investors;

universities

should play to their strengths, and these strengths include the ability

to take the long view, to creatively utilize real estate assets, and to

create, disseminate and apply advanced knowledge.

The actions recommended in this report should not be taken as

immutable;

the stock market and investor enthusiasms will inevitably shift,

opening

new opportunities for universities. But for now, universities

should

not attempt to “help” dotcom/e-commerce companies with narrow market

windows

by putting them in incubators that are subject to restrictive rules of

university bureaucracy. These companies are better served by

private

investor incubators, but the university can assist by contracting with

the investors, to create the maximum interaction with university

programs

and resources.

University-owned incubators can best help other kinds of

high-growth-potential

companies. In rural areas, this might mean plant biotechnologies

(like the algae projects in Maui’s incubator), or telemarketing /

service

center businesses, or multi-level businesses that do not require

venture

capital to kick-start their growth. University and rural

incubators

can take heed that “all businesses will be e-businesses,” helping local

businesses survive and gain efficiency by automating their

transactions.

University and rural incubators can grow companies that provide the

telecommunications

or other infrastructure services that facilitate the Internet

economy.

They can also nurture companies that take the long view of the

transformative

power of the Internet, looking beyond the quick-hit profits to be made

by “attracting eyeballs” to websites and selling groceries over the

Net.

Tornatzky et al (1996) provide an admirable comparative view of many

university-connected incubators. While those authors, and the

case

studies above, include many universities in the eastern U.S., the

individualistic

ethos of the west might suggest that Oregon look to other western role

models. Two of Tornatzky et al’s summaries are extracted below to

conclude this report.

UBC Research Enterprises at University of British Columbia is a good

example of a positive organizational arrangement. This office

deals

with all aspects of the university’s portfolio of sponsored research

with

industry, as well as all aspects of intellectual property management,

patenting,

and licensing. In addition, it takes on the task of functioning

as

an incubator without walls....The office is willing to assist faculty

inventors

as they work through the entrepreneurial process. In contrast

with

many university technology offices, which tend to focus exclusively on

licensing to already established companies, UBC Research Enterprises

routinely

provides (or brokers) many of the services that traditional incubators

offer.

Wichita Technology Corporation is one of three nonprofit

“commercialization

corporations” established by the Kansas Technology Enterprise

Corporation

(KTEC), each of which is collocated with a state research university...

the commercialization corporations ar independent

not-for-profits.

However, they are programmatically linked with the university.... The

commercialization

center will review technologies emerging from the university and...

identify

those that have the potential... for a significant business.

WTC’s

role...is... putting together the business - which might imply pulling

in other technologies - identifying other business partners, securing

capitalization,

and so on. Since the parent organization, KTEC, also invests

heavily

in university-based research centers of excellence, the

commercialization

corporation has ready access to university technologies.

Author Contact Information:

Fred Phillips

General Informatics LLC

15695 SW Bobwhite Cir., Beaverton, OR, 97007

503-579-0744

stilatexan@aol.com

Berglund, Dan. University-Industry Partnerships: Examples

& Lessons Learned. State Science & Technology

Institute.

September 1999.

Bienkowski, Dr. Robert S. “Internal Incubators.” Email:

Office of Technology Transfer, North Shore - Long Island Jewish Health

System. January 26, 2000.

Bixby, Pam. "Texas MBAS Hatch Big Ideas at the Austin Technology

Incubator." Texas. Spring 1999: 18-20.

Breamer, Dallas. “Prospective Tenant Questionnaire.”

Tri-Cities

Enterprise Association, Richland, WA, 1998.

Christensen, Jean. “High-Tech companies sprout on former Maui

farm land.” Associated Press, February 28, 2000.

Fox, Loren. "Hatching New Companies." UPSIDE. February

2000: 145-152.

Francis, Mike. “Garage.com shops for deal among Oregon’s

entrepreneurial

elite.” The Oregonian, November 29,1999, p.D1.

Hall, John. Presentation for the Meeting with Jim Coonan &

Diane Vines. Portland, Oregon: January 2000.

Hayhow, Sally, ed. A Comprehensive Guide to Business

Incubation.

Athens, Ohio: NBIA Publications, 1996.

Jones, Steven D. “Oregon makes headway as breeder of high-tech.”

Wall Street Journal, December 15, 1999, p. NW1.

Kalis, Nanette. Equity and Royalty Agreements for Business Assistance

Programs. National Business Incubation Association. Athens,

Ohio, ©1997.

Kelly, Jason. “Filling in the triangle: North Carolina’s tech

center tries to come together.” Upside. December, 1999.

p.229-230.

Kozmetsky, George. “Gaining Perspective.” Remarks to the Austin

Technology Incubator 1996 graduation ceremony, September 26,

1996.

IC2 Institute, University of Texas at Austin.

Manoa Innovation Center. http://www.htdc.org/mic/mic.html

McKinnion, Susie & Sally Hayhow. 1998 State of the Business

Incubation Industry. Athens, Ohio: NBIA Publications, 1998.

Molnar et. al. Business Incubation Works. Athens, Ohio:

NBIA Publications, 1997.

National Business Incubation Association. “Industry Facts and

Figures.” March, 1995. NBIA, Athens, Ohio.

National Business Incubation Association. NBIA Review. Jan/Feb,

1996. NBIA, Athens, Ohio.

Phillips. Fred. “Incubator Activities and the University-Incubator

Relationship.” Presentation to the Japan Research Institute,

Tokyo,

June, 1992.

Press, Eval, and Jennifer Washburn. “The Kept University.”

Atlantic Monthly, March, 2000, 39-54.

Tice, Carol. “UW incubator to be learning center for students,

faculty.” Seattle P-I (?), (1999, day and month unknown), sent to

me by fax by Bill Newman of SVP.

Tornatzky, Batts, McCrea, Lewis, & Quittman. The Art &

Craft of Technology Business Incubation. Athens, Ohio: Southern

Technology

Council, and the NBIA publications, 1996.

Wong, Daniel D. “Comparative analysis of hi-tech entrepreneurship

activity and its supporting environment between Portland, Oregon, and

Vancouver,

British Columbia.” Oregon Graduate Institute of Science and

Technology,

December, 1995.

The initial goal of the new Andersen centers will be to cut

down

on the time

it takes an e-business to go from a seed-funded start-up to a

revenue-producing business.

"There is an incredible market demand for access to management

and

technology skills during the 'post-incubation' period," Tolan

said in a

prepared statement. "Venture capital firms, strategic investors

and

traditional corporations need to speed their investments to

market

in order

to maximize the return on invested capital. Up until now, they

had nowhere

to turn."

Andersen will target new companies with one or two rounds of

funding behind

them.

"We are interested in what you might call the second-stage

launch,

when they

already have a handful of employees and have developed a

prototype

based on

their business model," Brian Johnson, partner and co-leader of

Chicago's

Launch Centre, told the Daily. "By then it's easier to separate

the Internet

winners from the Internet losers."

Andersen is widely considered the Big Five front-runner in the

dot-com

space--Scient founder and Chairman Eric Greenberg considers them

one of the

only established consulting giants to become a serious competitor

in the

systems integration space. The company has worked with or

invested

in 175

dot-coms within the past two years.

"In creating these centers, we are providing our clients with

unmatched

resources to achieve success in the e-commerce marketplace, and

in so doing,

we will continue to play a leading role in the new economy,"

said CEO Joe

Forehand in a prepared statement. The $8.3 billion firm employs

nearly

65,000 people in 48 countries.

The centers will provide the usual angel and VC funding

resources,

management, financial, and technical support, and business

development

tools

many incubators offer. But of Andersen's 17 centers in the works,

13 will be

planted outside of the U.S.

"Replicating your business model globally is key," Johnson said,

noting that

Microsoft earns 50 percent of its net income from outside the

U.S. "As soon

as you launch your site, some smart entrepreneur in another

country

can

figure out how to clone your business... What we can do beyond

the

consulting is give [start-ups] an instant network they can use

to connect

with our worldwide client base."

Andersen is widely considered the Big Five front-runner in the

dot-com

space--Scient founder and Chairman Eric Greenberg considers them

one of the

only established consulting giants to become a serious competitor

in the

systems integration space.

According to Forrester, this move allows Andersen to claim

ownership

of the

life cycle of a dot-com--from incubation to profitability.

"Andersen

recognizes that launching a dot-com is not just about securing

funding and

wooing Wall Street," Forrester Analyst Christine Spivey Overby

wrote in a

recent report. "With this international focus, Andersen will:

1) leapfrog

other providers' U.S.-only incubation services, 2) build out

its global

portfolio of e-business clients, and 3) tap undiscovered Internet

talent and

ideas that feed both U.S. and international engagements."

Blueprints have been drawn for Launch Centres in Atlanta, Boston,

Chicago,

Dublin, Frankfurt, Helsinki, Johannesburg, London, Madrid, Milan,

Palo Alto,

Paris, Sao Paulo, Singapore, Stockholm, Sydney, and Tokyo. Every

center will

be led by two Andersen partners, each under Tolan's tutelage.

"We are providing fledgling dot-com businesses with the specific

resources

they require, at the moment they need them, to quickly enter

the

marketplace," Tolan said. "It's often said that in the e-economy

it's better

to be first than to be right--our clients will be able to be

both."

Contact Eric Jackson: 917-452-5151, eric.s.jackson@ac.com

http://www.ac.com

In 1966 a young physiologist at the University of Florida started

giving

an

experimental electrolyte drink to the freshman football team.

That year, the Gators began a winning streak that earned them a

reputation

as a "second-half team" by kicking ass in the final plays.

The team's stamina was attributed to the fruity fluid-replacement

drink,

developed by medical researcher Dr. Robert Cade.

"We didn't have Gatorade," the coach of an opposing team told Sports

Illustrated after losing to the Gators. "That made the difference."

With these words, one of the most successful products to come out of

university research was born.

Currently, Gatorade <http://www.gatorade.com/> earns the

manufacturer,

Quaker Oats, $1.3 billion in annual sales, and for years has been one

of the

University of Florida <http://www.ufl.edu/>'s top money-making

spin-offs.

The Gatorade story, is not, however, typical.

With a few notable exceptions, most university research is never

commercialized. Instead, it is doomed to a life of obscurity on a

laboratory

shelf.

But entrepreneur Craig Zolan wants to change that with a new Internet

technology marketplace that matches technology sellers with technology

buyers.

Zolan's UVentures <http://www.uventures.com/> is an eBay for

patent

holders.

Researchers at colleges around the globe list their inventions in the

hopes

of catching the eye of a mega-corporation hunting for the next

breakthrough

idea.

Zolan, who comes from a family of entrepreneurs -- all five siblings

and his

parents started their own businesses -- knew a tech marketplace was

a good

idea when he floated that idea one afternoon during a visit to a

university.

He was immediately pitched 20 or more undeveloped technologies.

"There are a lot of lost opportunities," he said. "I did some

investigating

and realized it was epidemic among institutions. There is a lot of

technology that can be commercially viable but it is just sitting

there."

According to Zolan, with the exception of Stanford

<http://www.stanford.edu/>, the University of California, and MIT

<http://www.mit.edu/>, most universities and colleges are not

very

good at

capitalizing on the ideas hatched in their labs.

While many of these institutions have offices for "technology

transfer,"

as

it's known, they tend to be under-funded, under-staffed, and rely on

a

hopelessly outdated business practice: personal contacts.

"Universities aren't in the business of selling products," said Zolan,

UVentures' CEO. "They are in the business of teaching and research.

They

want to license these things out but the problem is they don't know

how to

do so in an efficient manner. A lot of opportunities are lying fallow

and

going to waste."

Citing figures from the Association of University Technology Managers

<http://www.autm.net/>, Zolan said that in 1998 universities

spent

$24

billion on research, but earned only $725 million from licensing it.

If only a fraction of that expenditure can be recouped, Zolan reasons,

the

rewards for UVentures, which takes a percentage of any licensing deals,

could be significant.

"Industry typically generates $10 for every $1 spent on R&D," he

said.

"Universities are generating 10 or 20 cents on the dollar. Even a 10

to 15

percent increase translates into huge dollars."

So far the site has listed 3,200 technologies from 37 different

universities

in the United States, Europe, and Asia. The technologies range from

new

drugs, chemicals, and materials to new ways of performing Internet

searches

and telephony over the Net.

Though UVentures has yet to make a sale, Zolan claims to have set up

about

25 matches. He noted that the Byzantine licensing process sometimes

takes

years to navigate.

"It can be very complex," he said. "It's not one-click shopping."

Carl Oppedahl, a patent lawyer with Oppedahl and Larson

<http://www.patent.com/>, said technology licensing is

notoriously

haphazard.

"There are some universities that have made enormous amounts of money

from

their patents," Oppedahl said. "But there are enormous untapped

resources

in

the patent portfolios of other institutions."

UVentures joins a rapidly growing sector of technology marketplaces

on the

Internet. Late last year saw the launch of a slew of new Intellectual

Property marketplaces, including yet2.com <http://www.yet2.com>,

which

concentrates on selling technology developed by corporations; TechEx

<http://www.techex.com>, which focuses on the life sciences; and

the Patent

& License Exchange <http://www.pl-x.com/>, a patent auction.

While skeptical that new websites will sweep away the old ways of

licensing

good ideas, Oppedahl predicted technology licensing will benefit from

Net

matchmakers.

Terry Young, executive director of Texas A&M University System

<http://tamusystem.tamu.edu/>'s technology licensing office, also

cast a

cold eye on the new startups.

"This is a growing area based on the notion that you can license

technology

by just putting a piece of paper in someone's hand," Young said. "But

that's

not the way it happens. You have to know how to transfer the know-how

and

the technology. It's really a person-to-person kind of business."

Young said at best, IP marketplaces will prove to be just another tool

for

good old-fashioned networking.

"We're all looking for ways to spread the word about our

opportunities,"

he

said. "But when it comes right down to it, these things will only help

you

find people. Then you have to do the face-to-face, person-to-person

transfer."